Navigating U.S. Clean Energy Transitions under the One Big Beautiful Bill (OBBB)

The biggest takeaways from the new legislation

This article is written by Lisa Nguyen, representing views from impactECI

The U.S. energy sector is undergoing rapid transformation with new policies, like the ones that drove the OBBB law, driving significant shifts in market direction and regulatory certainty. We’ve summarized the key changes, including the accelerated phase-out of major tax credits and the introduction of targeted incentives for emerging technologies. These shifts are reshaping supply chains, redirecting capital, and prompting organizations to rethink their strategic priorities.

For industry leaders, staying ahead means understanding how new legislation is influencing incentives, risks, and opportunities. Adapting quickly to this dynamic environment is essential for capturing value and maintaining a competitive edge in the energy transition.

1. U.S. Clean Energy Policy: Shaped by Political Cycles

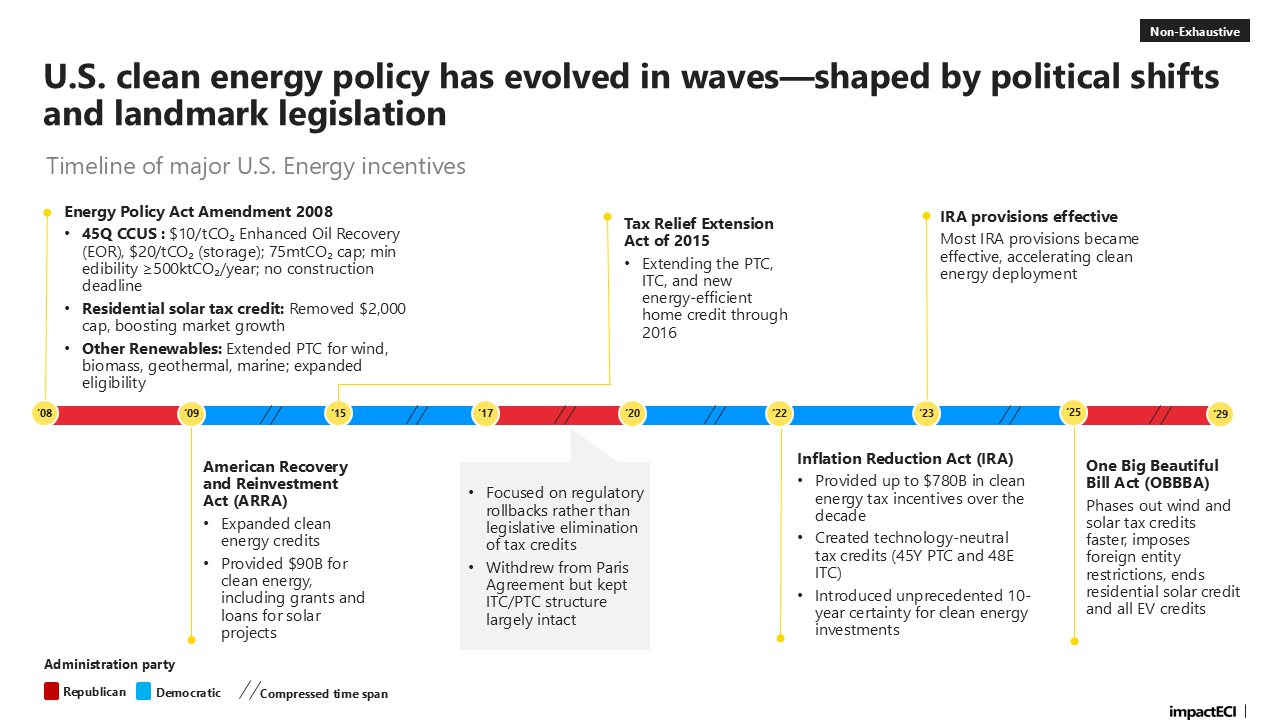

U.S. clean energy policy has progressed in legislative waves—each driven by political shifts and landmark acts. Major bills like the IRA and ARRA spurred renewable growth, while the proposed OBBB signals a faster phase-out of key incentives, highlighting how policy changes can rapidly redirect the energy market.

2. OBBB vs. IRA: Key Tax Incentive Changes

The latest policy overhaul marks a decisive shift in the clean energy landscape, accelerating the sunset of foundational tax credits for wind, solar, residential solar, and electric vehicles, while introducing more stringent requirements around foreign supply chain participation. At the same time, incentives for geothermal, nuclear, storage, carbon capture, and clean fuels remain intact but are subject to tougher standards, channeling market momentum toward domestically sourced and diversified clean energy solutions.

3. Disruption: Supply Chains & Capital Flows

Accelerated phase-outs of tax credits and new restrictions are stalling renewable projects, contracting supply chains, and shifting capital away from wind, solar, SAF, EVs, and hydrogen once incentives expire. As a result, the sector faces higher costs, slower deployment, and increased reliance on fossil fuels by 2035.

4. Capital Moves to Emerging Winners

With legacy incentives fading, investment is flowing to tech-neutral credits, storage, carbon capture, and clean fuels. These segments benefit from stable policy support, attracting capital and enabling continued innovation, while driving a more resilient energy ecosystem.

5. Strategic Implications for the Energy Transition

New policy shifts are accelerating disruption throughout the energy value chain, intensifying challenges like supply chain complexity, higher carbon footprints, rising electricity costs, and workforce mismatches. Companies face compressed project timelines, increased compliance burdens, and shifting capital flows, while incentives drive domestic manufacturing and geographic reshuffling. The result is a more fragmented, dynamic market that demands rapid adaptation and strategic focus to navigate heightened volatility and seize emerging opportunities.

For more information, reach out to hello@impactECI.com

The views and opinions in these articles are solely of the authors. They are offered to stimulate thought and discussion and not as legal, financial, accounting, tax or other professional advice or counsel.